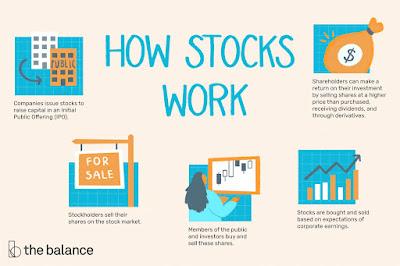

Investing in stocks and shares has long been recognized as a powerful means of generating wealth and achieving financial goals. With the potential for high returns, investing in the stock market offers individuals the opportunity to grow their capital over time. However, success in the stock market requires knowledge, strategy, and a disciplined approach. In this blog post, we will provide a detailed guide on how to make money with stocks and shares, with examples to illustrate each point.

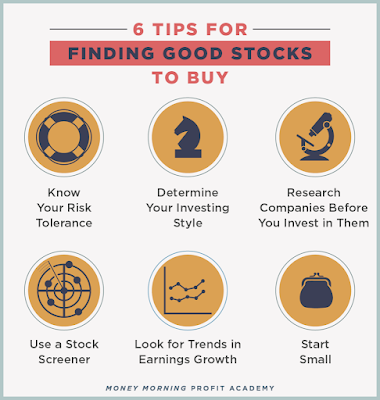

Educate Yourself: For example, you can start by reading books like "The Intelligent Investor" by Benjamin Graham or "A Random Walk Down Wall Street" by Burton Malkiel. Online courses, such as those offered by Udemy or Coursera, can provide structured learning on stock market fundamentals and investment strategies. Additionally, financial websites like Investopedia offer comprehensive resources to expand your knowledge.

Set Clear Goals:For instance, your goal could be to accumulate $500,000 for retirement in 20 years. This goal will help guide your investment strategy and determine the level of risk you are willing to take.

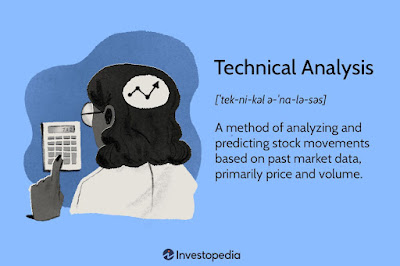

Research and Analyze: As an example, let's say you are interested in investing in technology companies. Research the financial health, competitive positioning, and growth prospects of companies like Apple Inc., Microsoft Corporation, and Alphabet Inc. Analyze their financial statements, quarterly earnings reports, and news updates to assess their performance and potential.

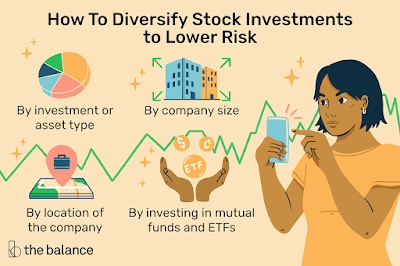

Diversify Your Portfolio: For example, if you have a $50,000 investment portfolio, consider allocating your funds across different sectors like technology, healthcare, consumer goods, and finance. Within each sector, invest in multiple companies to spread the risk. This diversification helps ensure that a downturn in one sector does not heavily impact your overall portfolio.

Long-Term Perspective: For instance, suppose you invest $10,000 in an index fund that tracks the performance of the S&P 500. Historically, the stock market has provided an average annual return of around 7-10% over the long term. By staying invested for 10 or more years, you can benefit from the compounding growth of your investment.

Choose Your Investment Approach: a. Value Investing: For example, Warren Buffett, one of the most successful investors, follows a value investing approach. He looks for undervalued companies with strong fundamentals, such as low P/E ratios or high dividend yields.

b. Growth Investing: Consider investing in companies like Amazon.com Inc. or Tesla Inc., which have shown significant revenue and earnings growth over the years. These companies have the potential to deliver substantial returns as their businesses continue to expand.

c. Dividend Investing: As an example, look for established companies with a history of paying consistent dividends, such as The Coca-Cola Company or Johnson & Johnson. These companies typically generate stable cash flows and distribute a portion of their earnings to shareholders as dividends.

Practice Risk Management:For instance, suppose you decide to allocate a maximum of 5% of your portfolio to any single stock. This approach ensures that even if one of your investments underperforms or faces financial difficulties, it will not significantly impact your overall portfolio.

Stay Disciplined: As an example, imagine the stock market experiences a sudden downturn, causing panic among investors. However, as a disciplined investor, you stick to your investment strategy and refrain from making impulsive selling decisions based on fear. Instead, you focus on the long-term prospects of your investments.

Consider Professional Advice: If you are uncertain about managing your investments, seek advice from a qualified financial advisor. For example, they can assess your risk tolerance, financial goals, and time horizon to recommend suitable investment strategies. They can also provide guidance on adjusting your portfolio during changing market conditions.

Monitor and Review: As an example, regularly review your portfolio's performance using tools like brokerage account dashboards or investment tracking apps. Analyze the performance of individual stocks and their contribution to your overall portfolio returns. If a company's fundamentals deteriorate or there are significant changes in the market, consider adjusting your portfolio allocation accordingly.

Making money with stocks and shares requires knowledge, research, discipline, and a long-term perspective. By educating yourself, setting clear goals, diversifying your portfolio, and staying informed, you can enhance your chances of achieving success in the stock market. Remember to apply these principles with real-world examples and adapt them to your specific investment journey.

Comments

Post a Comment

Thanks for leaving comments. You are making this discussion richer and more beneficial to everyone. Do not hold back.