In today's globalized economy, investors constantly seek opportunities to diversify their portfolios and maximize returns. One avenue that has gained attention is investing in emerging market bonds. Emerging market bonds are debt securities issued by governments or corporations in developing countries. While these investments carry risks, they also present opportunities for wealth generation. This essay explores the potential benefits and considerations associated with buying emerging market bonds as a means of wealth generation, including the available rates and countries that offer higher rates.

I. Understanding Emerging Market Bonds:

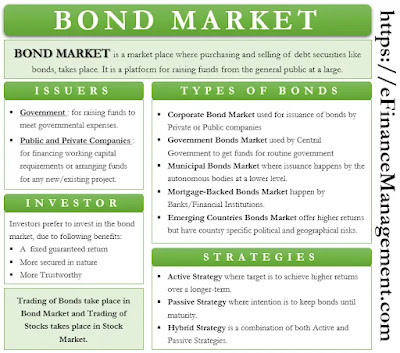

Definition and Characteristics: Emerging market bonds are fixed-income securities issued by governments or corporations in developing countries.

Sovereign Bonds: Issued by governments to raise capital for various purposes.

Corporate Bonds: Issued by private companies in emerging economies to finance their operations or expansion.

Factors driving investor interest in emerging market bonds:

- High potential for economic growth in emerging economies.

- Attractive yields compared to developed markets.

Diversification benefits for portfolios with exposure to different asset classes and geographical regions.

II. Benefits of Investing in Emerging Market Bonds:

Attractive Yields: Emerging market bonds often offer higher yields than those found in developed markets, providing the potential for higher returns on investment. Investors seeking income-generating assets can find appealing opportunities in emerging market bonds, especially in environments of low interest rates elsewhere.

Economic Growth and Diversification: Many emerging markets exhibit strong economic growth potential, driven by factors such as a growing middle class, expanding consumer markets, and infrastructure development. Investing in emerging market bonds allows investors to tap into this growth potential and diversify their portfolios beyond developed economies, potentially enhancing overall returns.

Favorable Risk-Reward Profile: While emerging market bonds carry higher risks compared to their developed market counterparts, they also offer potentially higher rewards.

Careful selection and diligent risk management can mitigate risks and create opportunities for significant capital appreciation.

III. Considerations and Risks:

Political and Economic Risks: Emerging markets can be susceptible to political instability, policy changes, and economic volatility. Investors must assess the stability of the country's political environment, fiscal policies, and regulatory framework before investing.

Currency Risk:Investing in foreign currencies exposes investors to exchange rate fluctuations. Currency depreciation can erode returns or lead to capital losses. Implementing hedging strategies or focusing on bonds denominated in stable currencies can mitigate this risk.

Liquidity and Market Accessibility: Some emerging market bonds may have limited liquidity and may be difficult to buy or sell quickly. Investors need to assess market accessibility and liquidity conditions to ensure they can manage their investments effectively.

IV. Strategies for Wealth Generation:

Fundamental Analysis: Conducting thorough research on the issuer's financial health, economic prospects, and creditworthiness. Assessing factors such as debt levels, revenue sources, interest coverage ratios, and geopolitical risks. Examining macroeconomic indicators and trends that may affect bond performance.

Diversification and Risk Management: Spreading investments across various emerging markets, regions, sectors, and issuers to mitigate risks. Balancing the portfolio with other asset classes and investment instruments to manage risk exposure effectively.

Active Management: Engaging experienced fund managers or investment professionals who specialize in emerging market bonds. Leveraging their expertise to identify opportunities, monitor market conditions, and make timely adjustments to the portfolio.

V. Available Rates and Countries with Higher Rates:

Yield Spectrum:Emerging market bonds offer a wide range of yields depending on various factors such as credit quality, maturity, and prevailing market conditions. Yields can range from relatively lower rates, comparable to developed market bonds, to significantly higher rates that reflect the risk premium associated with investing in emerging economies.

Countries with Higher Rates: Historically, countries such as Brazil, Turkey, Argentina, Indonesia, and South Africa have offered higher rates on their emerging market bonds. These countries often have complex economic and political environments, which contribute to higher yields to compensate investors for the associated risks. It is important to note that the rates offered by specific countries can change over time based on economic conditions, market sentiment, and government policies.

Investing in emerging market bonds presents an opportunity for wealth generation, thanks to the attractive yields, economic growth potential, and diversification benefits they offer. The rates available on emerging market bonds can vary widely, with certain countries historically offering higher rates to compensate for higher risk levels. However, it is crucial to acknowledge the associated risks, such as political and economic instability, currency fluctuations, and limited market liquidity. Implementing thorough research, diversification, and active management strategies can enhance the potential for successful wealth generation through investing in emerging market bonds. As with any investment, investors should carefully evaluate their risk tolerance, seek professional advice, and stay informed about the ever-evolving dynamics of emerging markets.

Related Posts:

1. TOP IDEAS TO CONSIDER IN ORDER TO MAKE MONEY WITH STOCKS AND SHARES

2. WEALTH CREATION -TOP TEN BEST & WORST IMPACTS OF GENERATIONAL WEALTH

3. COMPARING WEALTH GENERATION POTENTIAL & PITFALLS: STOCK MARKET VS. REAL ESTATE

4. DIFFERENT WAYS TO CREATE WEALTH - WHAT ACTIONS YOU CAN TAKE TO BECOME RICH?

Comments

Post a Comment

Thanks for leaving comments. You are making this discussion richer and more beneficial to everyone. Do not hold back.