The first mover advantage refers to the competitive edge gained by the initial player to enter a new market or industry. In the context of AI, this advantage arises from being the first to develop and deploy novel AI technologies, products, or services. By pioneering the adoption of AI, early movers can gain a head start over their competitors, establish brand recognition, and set industry standards.

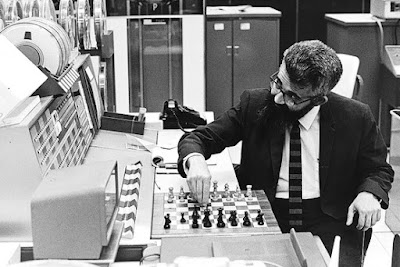

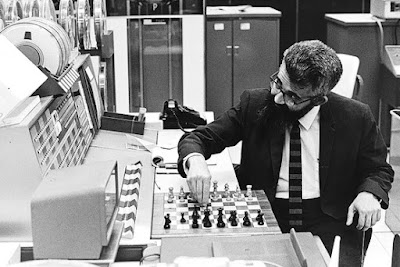

One example of the first mover advantage in AI is IBM's Watson. When Watson was introduced in 2011, it represented a groundbreaking advancement in natural language processing and cognitive computing. By being the first to develop such a sophisticated AI system, IBM positioned itself as a technological leader in the AI space. Watson's early success in winning the game show Jeopardy! showcased the potential of AI and set a new standard for intelligent systems. This propelled IBM to secure partnerships with various industries, including healthcare, finance, and customer service, establishing its market dominance in those areas.

Another notable example is Google's acquisition of DeepMind Technologies in 2014. DeepMind was a startup focused on artificial general intelligence and machine learning. By acquiring DeepMind, Google gained access to a wealth of AI talent and expertise, including renowned researchers and engineers. This early move allowed Google to strengthen its AI capabilities significantly, leading to the development of groundbreaking technologies such as AlphaGo, an AI program that defeated world champions in the complex game of Go. Google's first mover advantage in acquiring DeepMind provided them with a unique pool of resources and talent to drive further innovations in AI.

Netflix is an exemplar of leveraging the first mover advantage in AI to gather valuable data and create personalized recommendations. In 2006, Netflix launched the Netflix Prize, a competition challenging data scientists to improve its recommendation algorithm by 10%. This initiative allowed Netflix to accumulate a vast amount of user data, including ratings and viewing habits. The insights derived from this data, combined with the feedback loops generated by early user interactions, enabled Netflix to continuously refine its AI algorithms and provide highly accurate and personalized recommendations. This early advantage solidified Netflix's position as a leader in the streaming industry.

Tesla's early entry into the electric vehicle market illustrates the learning opportunities inherent in being a first mover. Despite facing initial challenges and criticisms, Tesla revolutionized the automotive industry with its electric vehicles and advanced driver-assistance systems. Through iterative product improvements, Tesla learned from early mistakes, such as production bottlenecks and battery technology limitations, to enhance its offerings. This knowledge, gained from being an early mover, positioned Tesla as a pioneer and set the foundation for its subsequent successes in the EV market.

In the rapidly evolving landscape of Artificial Intelligence, the first mover advantage holds significant potential for organizations aiming to establish themselves as leaders in the field. By pioneering the adoption of AI technologies, early movers can gain a competitive edge, shape industry standards, and solidify their market position. Examples such as IBM's Watson, Google's acquisition of DeepMind, Netflix's data-driven recommendations, and Tesla's electric vehicles showcase the benefits and impact of the first mover advantage in AI.

However, it is essential to acknowledge that being the first mover is not a guarantee of long-term success. The AI landscape is ever-evolving, and subsequent entrants armed with advancements and lessons learned can disrupt the status quo. Nevertheless, the first mover advantage remains a crucial factor that shapes the AI ecosystem and presents unique opportunities for those willing to seize them.

Related Posts:

1. TOP DISADVANTAGES OF INHERITANCE TAX IN THE UNITED KINGDOM AND IT'S IMPACT ON WEALTH CREATION

2. THE IMPACT OF INFLATION ON THE CREATION OF WEALTH: NAVIGATING A CHANGING FINANCIAL LANDSCAPE

4. THE POTENTIAL OF WEALTH GENERATION THROUGH INVESTING IN EMERGING MARKET BONDS

5. TOP IDEAS TO CONSIDER IN ORDER TO MAKE MONEY WITH STOCKS AND SHARES

Related Older Posts:

1. WEALTH CREATION -TOP TEN BEST & WORST IMPACTS OF GENERATIONAL WEALTH

2. COMPARING WEALTH GENERATION POTENTIAL & PITFALLS: STOCK MARKET VS. REAL ESTATE

3. COMPARING WEALTH CREATION POTENTIAL: UNITED STATES VS. UNITED KINGDOM

4. DIFFERENT WAYS TO CREATE WEALTH - WHAT ACTIONS YOU CAN TAKE TO BECOME RICH?

Comments

Post a Comment

Thanks for leaving comments. You are making this discussion richer and more beneficial to everyone. Do not hold back.